运筹系列87:julia求解随机动态规划问题入门

1. 入门案例:LinearPolicyGraph

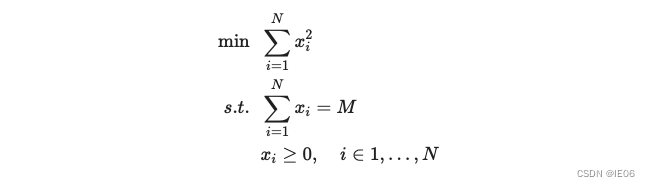

看一个简单的数值优化的例子:

我们将其建立为一个N阶段的问题:

初始值为M。

使用SDDP.jl进行求解:

using SDDP

import Ipopt

M, N = 5, 3

model = SDDP.LinearPolicyGraph(

stages = N,

lower_bound = 0.0,

optimizer = Ipopt.Optimizer,

) do subproblem, node

@variable(subproblem, s >= 0, SDDP.State, initial_value = M)

@variable(subproblem, x >= 0)

@stageobjective(subproblem, x^2)

@constraint(subproblem, x <= s.in)

@constraint(subproblem, s.out == s.in - x)

if node == N

fix(s.out, 0.0; force = true)

end

return

end

SDDP.train(model)

println(SDDP.calculate_bound(model))

simulations = SDDP.simulate(model, 1, [:x])

for data in simulations[1]

println("x_$(data[:node_index]) = $(data[:x])")

end

结果为

8.333333297473812

x_1 = 1.6666655984419778

x_2 = 1.6666670256548375

x_3 = 1.6666673693365108

非常接近理论最优值。

2 报童模型:加入随机变量

报童每天早上进一批报纸,需求有个大致的数,但是并不确定。那么报童要进多少报纸合适?

变量如下:

- 报纸成本c,零售价v

- 残值s,缺货损失p

- 需求为随机变量x,概率密度为f

- 决策变量为订货量Q

- 目标函数为max(利润-成本),假如x>Q,则利润=vQ,成本=cQ+p(x-Q)

- 最佳订货量Q满足到Q的概率积分=(v+p-c)/(v+p-s),推倒过程这里忽略

.我们缺货无损失,残值为0,零售价30.5,订货价20.5,则最佳订货量满足积分=0.328。若f为均值300,方差50的正态分布函数,则最佳订货量 = -0.445*50+300 = 278

我们使用Julia进行求解,首先要将正态分布离散化:

using Distributions,StatsPlots

D = Distributions.Normal(300,50)

N = 1000

d = rand(D, N)

P = fill(1 / N, N)

StatsPlots.histogram(d; bins = 80, label = "", xlabel = "Demand")

接下来是一个trick,这里是先决策再实现随机变量,因此把问题建成两阶段的模型,第一阶段决策为购买量u_make,第二阶段实现随机变量ω,随后决策为销售量u_sell。

模型如下:

using SDDP, HiGHS

model = SDDP.LinearPolicyGraph(;

stages = 2,

sense = :Max,

upper_bound = 20 * maximum(d), # The `M` in θ <= M

optimizer = HiGHS.Optimizer,

) do subproblem::JuMP.Model, stage::Int

@variable(subproblem, x >= 0, SDDP.State, initial_value = 0)

if stage == 1

@variable(subproblem, u_make >= 0, Int)

@constraint(subproblem, x.out == x.in + u_make)

@stageobjective(subproblem, -20.5 * u_make)

else

@variable(subproblem, u_sell >= 0, Int)

@constraint(subproblem, u_sell <= x.in)

@constraint(subproblem, x.out == x.in - u_sell)

# 把连续随机变量离散化

SDDP.parameterize(subproblem, d, P) do ω

set_upper_bound(u_sell, ω)

return

end

@stageobjective(subproblem, 30.5 * u_sell)

end

end

SDDP.train(model;)

rule = SDDP.DecisionRule(model; node = 1)

SDDP.evaluate(rule; incoming_state = Dict(:x => 0.0),controls_to_record = [:u_make])

输出为:

(stage_objective = -5699.0, outgoing_state = Dict(:x => 278.0), controls = Dict(:u_make => 278.0))

接下来进行仿真观察:

simulations = SDDP.simulate(

model,

10, #= number of replications =#

[:x, :u_make, :u_sell]; #= variables to record =#

skip_undefined_variables = true,

);

simulations[1][1]

收益如下:

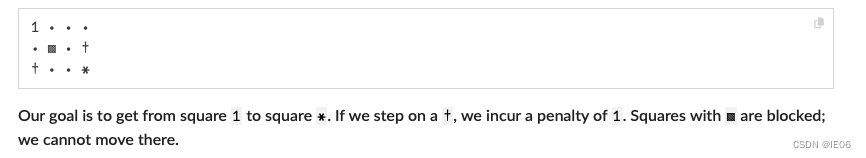

3 探索迷宫:UnicyclicGraph

首先构造一个迷宫:

M, N = 3, 4

initial_square = (1, 1)

reward, illegal_squares, penalties = (3, 4), [(2, 2)], [(3, 1), (2, 4)]

path = fill("?", M, N)

path[initial_square...] = "1"

for (k, v) in (illegal_squares => "?", penalties => "?", [reward] => "*")

for (i, j) in k

path[i, j] = v

end

end

print(join([join(path[i, :], ' ') for i in 1:size(path, 1)], '\n'))

定义P为所有满足可以移动到 (i, j)的(a, b) 集合。

使用SDDP.UnicyclicGraph,定义一个无限的循环图

discount_factor = 0.9

graph = SDDP.UnicyclicGraph(discount_factor)

定义了一个不断自循环的图:

Root

0

Nodes

1

Arcs

0 => 1 w.p. 1.0

1 => 1 w.p. 0.9

import HiGHS

model = SDDP.PolicyGraph(

graph;

sense = :Max,

upper_bound = 1 / (1 - discount_factor),

optimizer = HiGHS.Optimizer,

) do sp, _

# Our state is a binary variable for each square

@variable(

sp,x[i = 1:M, j = 1:N],Bin,SDDP.State, # 每一阶段都是M*N的状态变量

initial_value = (i, j) == initial_square, # 初始位置(1,1)

)

# 只能在一个位置

@constraint(sp, sum(x[i, j].out for i in 1:M, j in 1:N) == 1)

# Incur rewards and penalties

# 这里reward是终点位置,penalties是所有惩罚点的位置

@stageobjective(sp, x[reward...].out - sum(x[i, j].out for (i, j) in penalties))

# Constraints on valid moves

for i in 1:M, j in 1:N

# 允许移动的位置

moves = [(i - 1, j), (i + 1, j), (i, j), (i, j + 1), (i, j - 1)]

filter!(v -> 1 <= v[1] <= M && 1 <= v[2] <= N && !(v in illegal_squares), moves)

# 移动出去的值不能大于其他位置进去的值的和。由于都是Bin变量,因此等价于说从i,j移动到了某个允许的a,b上

@constraint(sp, x[i, j].out <= sum(x[a, b].in for (a, b) in moves))

end

return

end

SDDP.train(model)

simulations = SDDP.simulate(

model,

1,

[:x];

sampling_scheme = SDDP.InSampleMonteCarlo(

max_depth = 10,

#terminate_on_dummy_leaf = false,

),

);

for (t, data) in enumerate(simulations[1]), i in 1:M, j in 1:N

if data[:x][i, j].in > 0.5

path[i, j] = "$t"

end

end

print(join([join(path[i, :], ' ') for i in 1:size(path, 1)], '\n'))

注意Simulating a cyclic policy graph requires an explicit sampling_scheme that does not terminate early based on the cycle probability。结果为:

1 2 3 ?

? ? 4 ?

? ? 5 *

4 牛奶制造:MarkovianGraph

使用MarkovianGraph可以接受一个仿真器graph = SDDP.MarkovianGraph(simulator; budget = 30, scenarios = 10_000);

buget是node的个数,scenarios是计算转移概率时的采样个数。这里使用Markovian过程来模拟一个随时间变化的过程,node的个数需要大于stage的个数,node越多,模拟越精确。

这里问题描述如下:

- 产奶量不确定,牛奶市场价格不确定

- 需求无限。未售出的牛奶可以制成奶粉

- 公司也可以接订单,按照当前价格收款,但是4个月之后交付。届时产能不够的话,需要额外购买牛奶。

- 决策为需要接多少订单

首先我们用预测模型给出牛奶的价格,假设模型如下:

function simulator()

residuals = [0.0987, 0.199, 0.303, 0.412, 0.530, 0.661, 0.814, 1.010, 1.290]

residuals = 0.1 * vcat(-residuals, 0.0, residuals)

scenario = zeros(12)

y, μ, α = 4.5, 6.0, 0.05

for t in 1:12

y = exp((1 - α) * log(y) + α * log(μ) + rand(residuals))

scenario[t] = clamp(y, 3.0, 9.0)

end

return scenario

end

plot = Plots.plot(

[simulator() for _ in 1:500];

color = "gray",

opacity = 0.2,

legend = false,

xlabel = "Month",

ylabel = "Price [\$/kg]",

xlims = (1, 12),

ylims = (3, 9),

)

用30个点模拟出来的转移概率图如下:

for ((t, price), edges) in graph.nodes

for ((t′, price′), probability) in edges

Plots.plot!(

plot,

[t, t′],

[price, price′];

color = "red",

width = 3 * probability,

)

end

end

plot

接下来给定具体数值:

- 产奶量不确定,为0.1-0.2之间的均匀分布。生产没有成本。

- 牛奶市场价格按照node进行概率转移,售出价格1倍

- 需求无限。未售出的牛奶可以制成奶粉然后在下个月以同样价格售出。

- 公司也可以接订单,按照当前价格收款,但是4个月之后交付。成本为绝对值0.01,四个月后售出价格为1.05倍

- 届时产能不够的话,需要额外购买牛奶。费用1.5倍

- 决策为需要接多少订单

建模如下:

model = SDDP.PolicyGraph(

graph;# 将price用graph随机过程来模拟,不用再单独建随机变量来模拟

sense = :Max,

upper_bound = 1e2,

optimizer = HiGHS.Optimizer,

) do sp, node

t, price = node::Tuple{Int,Float64}

c_buy_premium = 1.5

Ω_production = range(0.1, 0.2; length = 5)

c_max_production = 12 * maximum(Ω_production)

# 两个状态变量

@variable(sp, 0 <= x_stock, SDDP.State, initial_value = 0) # track库存变量

@variable(sp, 0 <= x_forward[1:4], SDDP.State, initial_value = 0) # track forward变化

# 三个核心决策变量

@variable(sp, 0 <= u_spot_sell <= c_max_production)

@variable(sp, 0 <= u_spot_buy <= c_max_production);c_max_futures = t <= 8 ? c_max_production : 0.0

@variable(sp, 0 <= u_forward_sell <= c_max_futures)

# 一个随机变量

@variable(sp, ω_production)

# Forward contracting constraints:

@constraint(sp, [i in 1:3], x_forward[i].out == x_forward[i+1].in)

@constraint(sp, x_forward[4].out == u_forward_sell)

@constraint(sp, x_stock.out == x_stock.in + ω_production + u_spot_buy - x_forward[1].in - u_spot_sell)

Ω = [(price, p) for p in Ω_production]

SDDP.parameterize(sp, Ω) do ω::Tuple{Float64,Float64}

fix(ω_production, ω[2])

@stageobjective(sp, ω[1] * (u_spot_sell - 1.5 * u_spot_buy) +(ω[1] * 1.05 - 0.01) * u_forward_sell)

return

end

return

end

SDDP.SimulatorSamplingScheme is used in the forward pass. It generates an out-of-sample sequence of prices using simulator and traverses the closest sequence of nodes in the policy graph.翻译过来就是SimulatorSamplingScheme会根据产生的随机变量,寻找最为接近的node路径。

AVaR(β) Computes the expectation of the β fraction of worst outcomes. β must be in [0, 1]. When β=1, this is equivalent to the Expectation risk measure. When β=0, this is equivalent to the WorstCase risk measure. 翻译过来就是AVaR综合了最差情况和均值。

SDDP.train(

model;

time_limit = 20,

risk_measure = 0.5 * SDDP.Expectation() + 0.5 * SDDP.AVaR(0.25),

sampling_scheme = SDDP.SimulatorSamplingScheme(simulator),

)

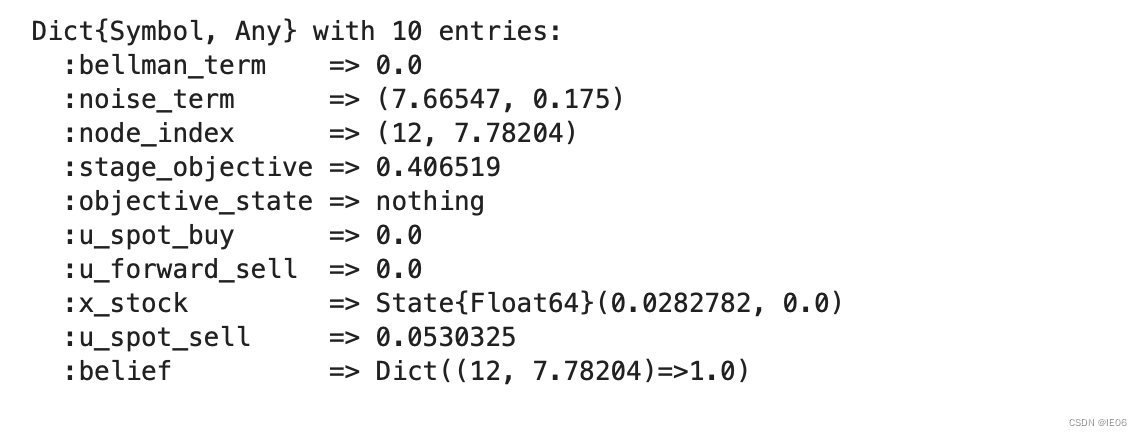

我们仿真一次:

simulations = SDDP.simulate(

model,

200,

Symbol[:x_stock, :u_forward_sell, :u_spot_sell, :u_spot_buy];

sampling_scheme = SDDP.SimulatorSamplingScheme(simulator),

);

simulations[1][12]

可以发现,node_index里面的price下标是7.78204, SDDP.parameterize的实际用的price是7.66547

本文来自互联网用户投稿,该文观点仅代表作者本人,不代表本站立场。本站仅提供信息存储空间服务,不拥有所有权,不承担相关法律责任。 如若内容造成侵权/违法违规/事实不符,请联系我的编程经验分享网邮箱:veading@qq.com进行投诉反馈,一经查实,立即删除!